Tax Reduction & Accounting Services That Are Actually Smart

Regardless of your current situation, TotTax can help you take control of your finances and maximize your tax benefits.

$195M

Managed Revenue

230+

Business Clients

96.1%

Client Retention

Get Your Business Finances Under Control.

Our Tax and Bookkeeping Services are designed to help our clients focus on what matters the most – business – and handle taxation, finances, and accounting. After just one session, you’ll feel more in control of your budget, your strategy, your goals, and your business.

Easy All-In-One Packages

Designed to take taxes, bookkeeping, and more off your plate!

Compliance Package

Best For: Small Teams • Around $500k Revenue

$895 /month

Accounting & Payroll

- Quarterly Bookkeeping + Reconciliation

- Up To 4 Employees/1099s Included

- Quarterly Financial Reports

- Payroll on Autopilot

- Sales Tax Filing & Support

Tax Reduction

- Annual Business Tax Return - LLC, Partnerships, & Corps.

- Strategic Quarterly Tax Planning

- Quarterly Estimated Tax Calculations

Advisory

- Bookkeeper Support - Q/A

Collaboration Package

Best For: Teams • Around $2M Revenue

$1600/month

Everything From The Compliance Package

Accounting & Payroll

- Monthly Bookkeeping + Reconciliation

- Monthly Financial Reports

- (5) Employees/ 1099 Contractors Included

- Each Additional (5) Employees/1099s + $100/month

- Sales Tax Filing + Support

- Hands-On Payroll + Support

- Quarterly Cash Flow & Budgeting

- Employee Benefits + HR Support

Tax Reduction

- Annual Business Tax Return - LLC, Partnerships, & Corps.

- Strategic Quarterly Tax Planning

- Quarterly Estimated Tax Payment Submission

- Tax Notice Review

- Personal Tax Return Included (Limit One Owner)

Advisory

- Regular Advisory Meetings

- Profit & Cashflow Guidance

Fractional CFO Package

C-suite Level Financial Services

$3500 /month

Everything From Collaboration Package

Accounting & Payroll

- Bi-Weekly Bookkeeping

- Real-Time Dashboards

- Accounts Payable/Receivable

- Project Profitability

- Payroll + Benefits + HR support for a growing team

- Custom Forecasting, Budgeting, and Tax Strategy

Tax Reduction

- Annual Business Tax return - LLC, Partnerships, & Corps.

- Strategic Quarterly Tax Planning

- Quarterly Estimated Tax Calculations

- Tax & Growth Strategies (Trusts, Holding Co., Real Estate, etc.)

Advisory

- Priority Support │ Email, Phone, Text

- Monthly CFO Sessions

- Owner Wealth Strategy: Retirement Planning

- Entity Structure Review

Not Sure What’s Right For You?

What We Do Isn’t Just Numbers, It’s Tax And Accounting Services Focused On Strategy, Confidence & Growth

Bookkeeping & Cleanup

Everything starts here. Without clean books, we can’t plan, forecast, or save you money.

Payroll

We manage it all: payroll processing, tax filings, employee onboarding, S-Corp officer salaries, and more.

Advisory Services

Think of us as your behind-the-scenes CFO.

We’re here when you’re asking:

Can I afford to hire?

Should I buy this building?

Am I ready to scale?

Employee Benefits & HR Support

We help business owners structure creative benefits, avoid HR pitfalls, and stay compliant while seamlessly plugging into your HR Team.

Tax Planning

Tax planning isn’t about write-offs. It’s about decisions. We help you make moves before the year ends—so you’re not stuck with a surprise bill later.

Entity structure, retirement planning, owner draws, real estate grouping, depreciation—you name it, we plan for it.

Tax planning = the difference between paying $80K and $8K.

S-Corp Strategy & Election

Not sure if an S-Corp is right for you? Already have one but not sure it’s being handled properly? We help you elect at the right time, run clean payroll, and avoid common (and costly) S-Corp mistakes.

This is one of the most powerful tax strategies for small business owners—we’ll help you use it right.

Tax Resolution Services

We help resolve tax problems from simple IRS or State Agency notices to complex audits and multi-year issues.

Tax Preparation & Filing

This is the final step—not the first one. Your tax return is simply a summary of the strategic work we’ve done all year: clean books, smart payroll, timely elections, and intentional planning. We prepare and file business and owner-level returns to reflect the strategy—not guesswork.

Your return should tell a story the IRS understands—and respects.

ONE-TIME PROJECTS

(Flat-Fee Tax And Accounting Services)

Business Tax Returns

Starts at

$1,500

S-Corp / Partnership / C-Corp

Includes year-end bookkeeping review

Individual Tax Returns

(Business or Real Estate Owners)

Starts at

$1,200

Must include Schedule C self-employment activity or Real Estate Activities

Custom Tax Planning

(Standalone Project)

Starts at

$7900

For business owners who are tired of surprises and want a clear plan to save money on taxes—before tax season hits.

1:1 Tax Strategy Session (up to 90 minutes) with a licensed tax pro

Full business + personal review (we look at entity structure, payroll setup, income streams, deductions, etc.)

Custom tax savings strategy plan

Cash flow vs tax savings analysis

Audit of past 1–2 years of tax returns to catch missed savings

Implementation checklist so you or your accountant know what steps to take next

Optional: Quote to implement strategies with TotTax

When’s the Best Time to Do Tax Planning?

Early in the year is ideal. Why? Because tax planning is a long game. Some strategies must be set up months—or even a full tax year—in advance to be effective. Planning ahead means more options, less stress, and real savings.

Tax Resolution Projects

Starts at

$2,200

We help resolve tax problems from simple IRS or State Agency notices to complex audits and multi-year issues. Common (not limited to) cases we work with include:

Back taxes owed (IRS or State)

Payroll tax problems or missed filings

Sales tax issues or audits

IRS or State DOR notices and letters

Tax liens or wage garnishments

Innocent Spouse Relief

Identity theft and fraudulent filings

Non-filed tax returns (1+ years)

Penalty abatement requests

Complex business-level resolution cases

Innovative Ideas and Exceptional Accounting And Tax Services

At TotTax Tax, our team of experts is ready to provide you with excellent service. We're here to answer all your questions, and the best part is you don't even have to visit our office. We can work with you over the phone or email to fit your busy schedule.

If you need help with your personal income taxes or all accounting & taxation services for your small business, please get in touch with us today. TotTax is here to assist you.

Why Choose Us

TotTax Tax & Accounting Agency offers expert accounting, bookkeeping, payroll, tax planning, and tax preparation services for individuals and small businesses throughout the United States. We take a transparent and client-focused approach to your financial needs, providing the personalized attention you deserve from a professional firm.

Expertise and Trust

Benefit from our experienced and certified accountants, who provide trustworthy financial guidance, ensuring accuracy and compliance.

Proactive Partnership

Beyond historical reporting, we proactively identify opportunities and challenges, serving as your strategic accounting and consulting partners.

Tailored Solutions

We create customized financial strategies that align with your unique goals, offering personalized solutions that fit your needs.

Cutting-Edge Technology

We leverage the latest accounting software for efficiency, providing real-time insights to help you make informed decisions.

Comprehensive Services

From taxes to audits, we offer a full spectrum of services under one roof, ensuring your financial success.

Meet Tatyana, TotTax Founder

I'm your business tax professional and financial strategist. I tried different jobs at the IRS, like bookkeeping, accounting, and tax preparation.

However, I came to the realization that it wasn't the right fit for me.

I wanted to work with clients motivated and excited for changes, appreciating freedom, and ready for action. That's why I started TotTax, a Tax and Accounting Agency.

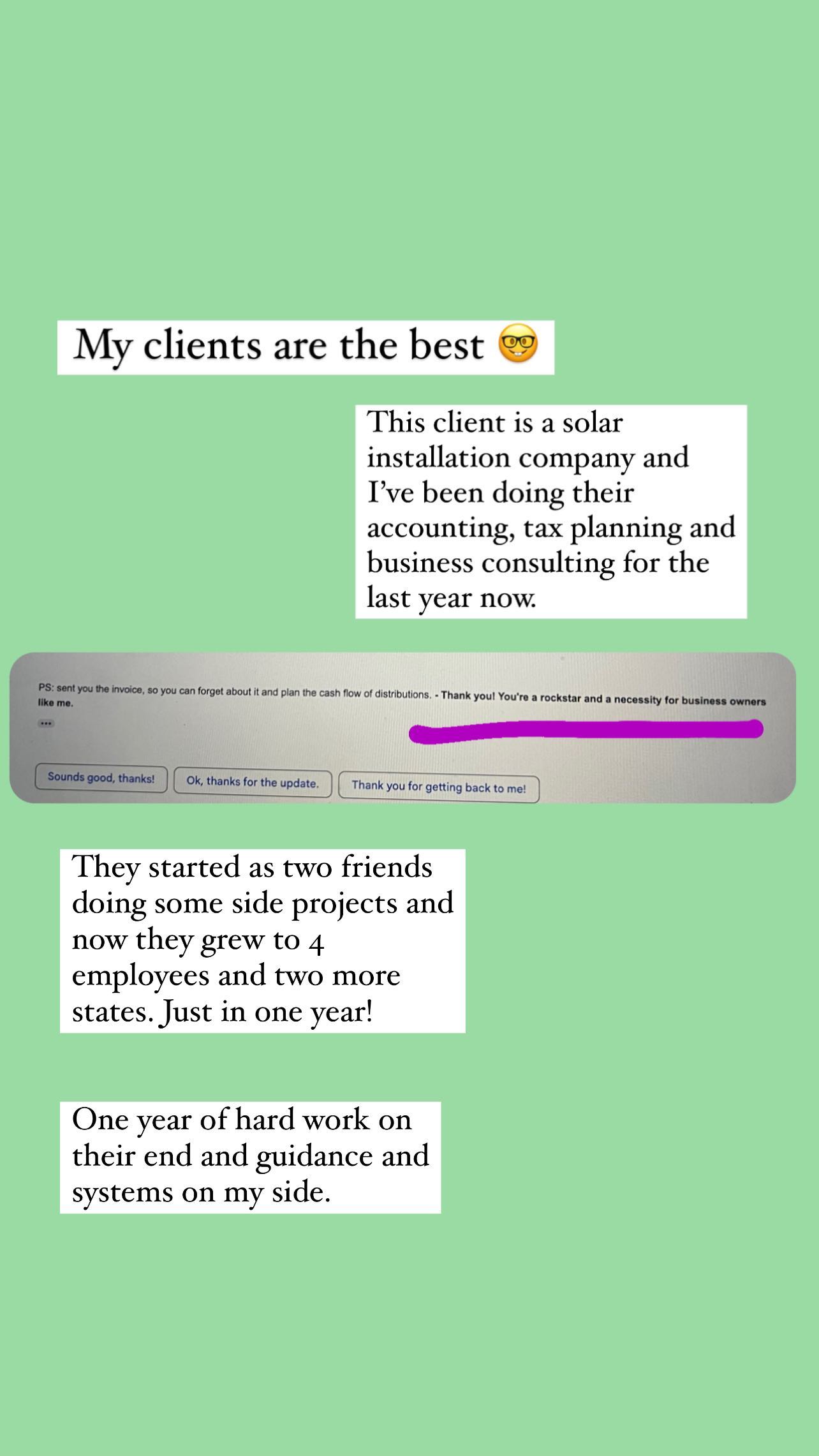

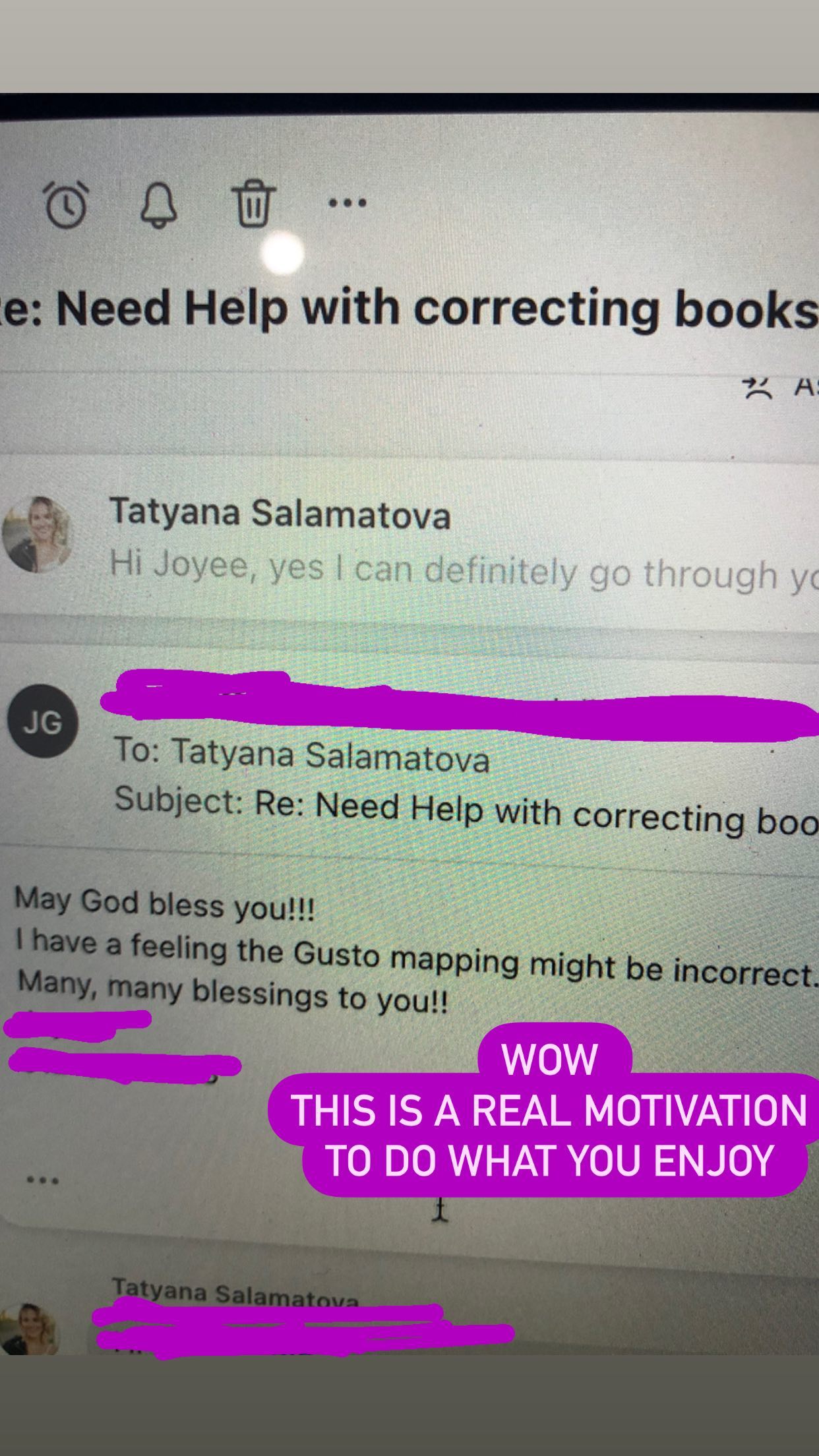

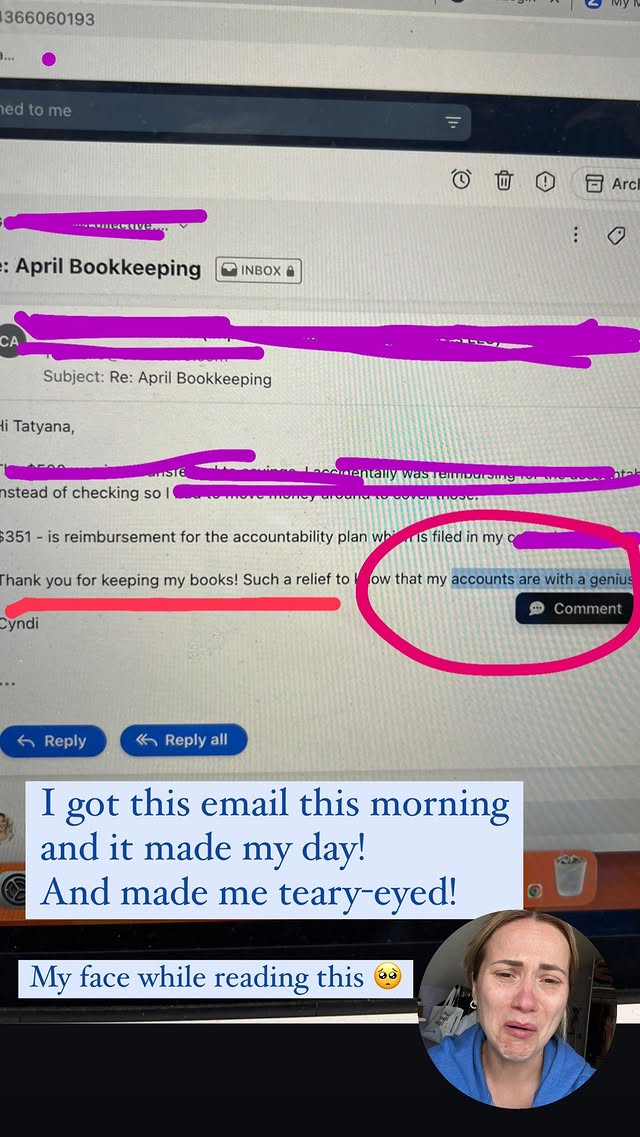

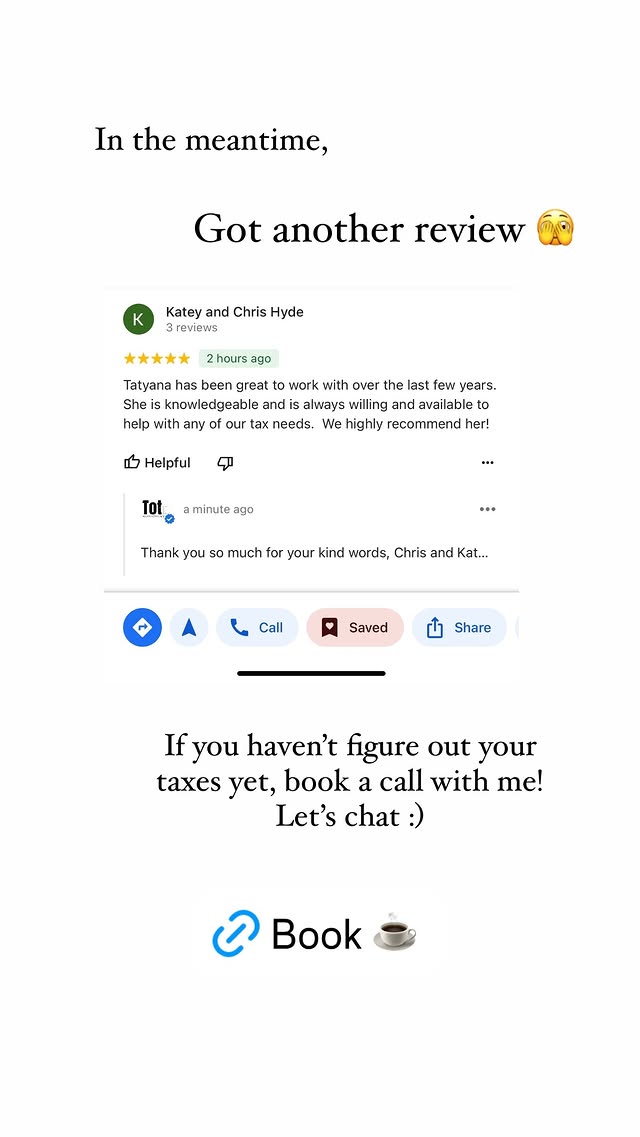

Our Recent Clients

We are proud to have partnered with a diverse range of clients, helping them achieve their financial and business goals with our expert services. Here are a few of our recent clients.

Industries We Serve

BLOGGING & SOCIAL MEDIA

E-COMMERCE & RETAIL

REAL ESTATE & RENTAL SERVICES

RESTAURANT & CATERING

CONSTRUCTION GS) & HOME SERVICES

IT & MARKETING

EDUCATION

ENTERTAINMENT (ARTISTS & MUSICIANS)

HR & FINANCIAL SERVICES

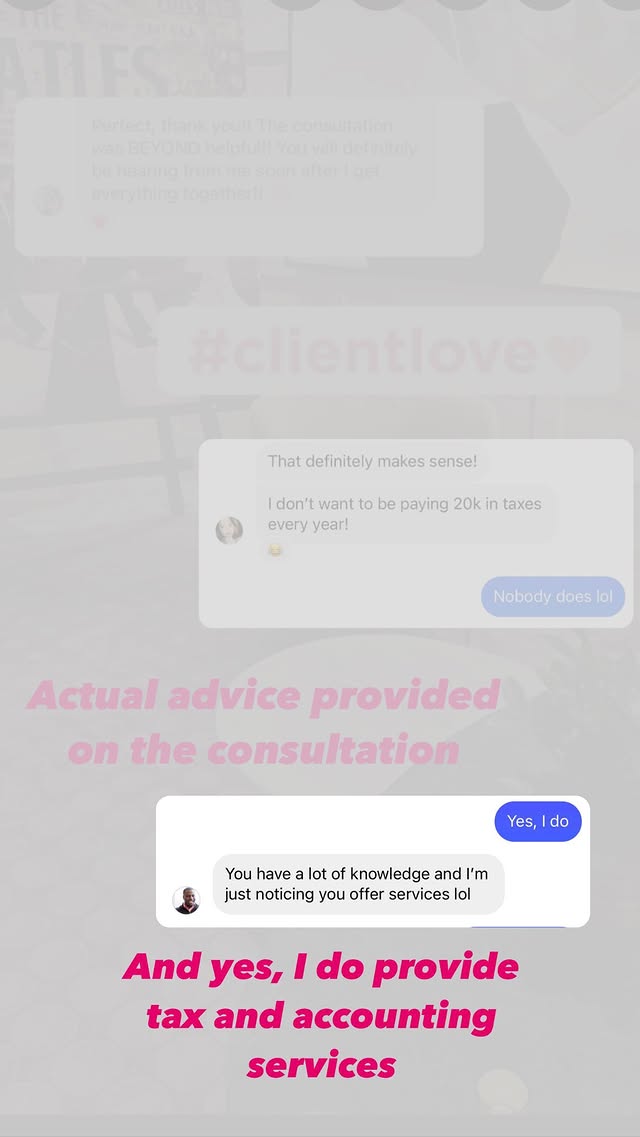

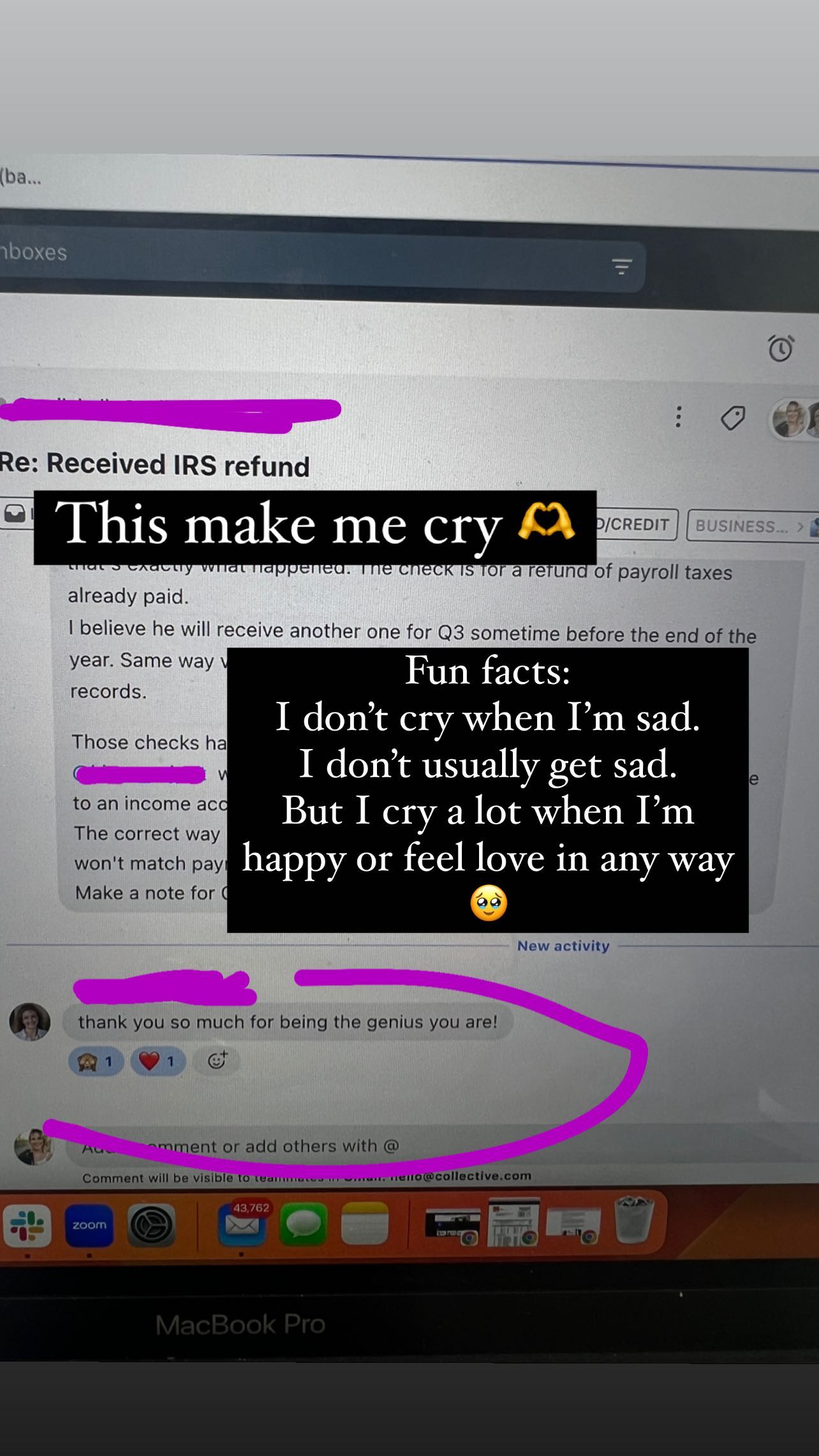

What Our Clients Say About Us

How to file taxes as a business

You would think that would be something of importance to know. But no, So how did I manage this?

Year 1: I paid someone $600 dollars to file & I owed about $7,000 to the government & I cried.

Year 2: I tried to do it myself…still owed about $7,000…

Year 3: I HIRED A PRO!

Not only was this tax season completely stress free BUT she managed to fix my previous year’s taxes (yes the ones I did) & get me an almost $3,000 REFUND!

So the moral of the story…hire out the things that you are not an expert in.

If you are looking for an amazing tax gal check out TotTax.

Stephanie

CEO of Money Moves Management

Absolutely happy with Tatyana and her team services. The only regret I have is that I didn't contact her earlier.

I've been a "1099-employee" since 2021, and I've always been financially literate, to say the least. So since 2023, the 2024 is going to be my full year as an LLC, so she walked me through the process of starting an LLC.

She had lowered my taxes—probably cut them in half. I started saving for retirement. She helped me with the retirement investments.

And yeah, if you're still questioning it—do it.

Alexandra Sarapulova, RN

Owner of Alexandra Sarapulova PLLC

Tax Accountant

TotTax Accounting can help you save time and focus on what’s important - running your business. We have a team of professional accountants, tax accountants, financial accountants, and tax advisors who are ready to provide professional assistance so that we'll work with the IRS, file returns when due while taking advantage of all incentives available for small businesses like yours, too! With our expertise, it will be easier than ever before to make informed decisions about future growth plans.

Most Commonly Asked Questions

-

TotTax can help your business by providing expert financial guidance, ensuring compliance with tax regulations, optimizing your tax strategies, simplifying bookkeeping, and offering personalized solutions to align with your unique goals.

-

TotTax distinguishes itself through its experienced and certified accountants, tailored financial strategies, proactive partnership approach, utilization of cutting-edge technology, and a comprehensive suite of services under one roof. The company's commitment to client success sets it apart.

-

Yes, TotTax can handle both state and federal tax requirements. Their team includes experts who are well-versed in local, state, and federal tax regulations to ensure full compliance.

-

TotTax serves both businesses and individuals. They offer services tailored to the unique needs of both small businesses and individuals seeking tax and financial assistance.

-

We take data security and privacy seriously. Our team follows industry-standard practices to protect your financial information, and we use secure communication channels for all interactions.