Quarterly Estimated Taxes: Deadlines, Penalties, and What Happens If You Underpay

What Are Quarterly Estimated Taxes?

Quarterly estimated taxes are advance payments made to the Internal Revenue Service throughout the year.

They apply to taxpayers who do not have enough tax withheld automatically, including:

Self-employed individuals and freelancers

S-corp owners

Real estate investors and real estate professionals

Partners in partnerships

Taxpayers who sold real estate during the year

Individuals with significant investment activity, such as trading, interest, or dividend income (including C-corp owners receiving dividends distributions)

Employees with high W-2 wages where the employer is under-withholding

Anyone with substantial income not subject to regular withholding

The IRS expects taxes to be paid as income is earned, not all at once when you file your return.

Quarterly Estimated Tax Deadlines (Not Calendar Quarters)

This is where most confusion starts.

The IRS divides the year into four payment periods, but they are not equal calendar quarters.

Here are the actual deadlines:

📅 IRS Estimated Tax Payment Deadlines

April 15 → for income earned January 1 – March 31

June 15 → for income earned April 1 – May 31

September 15 → for income earned June 1 – August 31

January 15 (following year) → for income earned September 1 – December 31

If a deadline falls on a weekend or holiday, it moves to the next business day.

Because these periods are uneven, relying on “quarterly averages” often leads to underpayments.

Why Tracking Income by IRS Tax Period Matters

Tracking income earned in each IRS tax payment period is especially important for businesses with seasonal or uneven cash flow. Real estate professionals, catering and wedding venues, photographers, and trade businesses paid on a project basis often earn income in spikes — not evenly throughout the year — which makes flat estimated payments risky and frequently leads to underpayment penalties.

Who Is Required to Pay Quarterly Estimated Taxes?

You generally must pay estimated taxes if:

You expect to owe $1,000 or more when you file

Withholding and credits won’t cover your total tax liability

This includes many:

Freelancers and contractors

S-corp owners paying themselves partially through distributions

Investors with pass-through income

If taxes aren’t withheld automatically, you are responsible for sending payments.

What Happens If You Underpay Estimated Taxes?

If estimated tax payments are too low or paid late, the IRS may assess:

Underpayment penalties

Interest

Late payment penalties

Possible state penalties, depending on where you file

A key point many taxpayers miss:

You can still owe penalties even if you receive a refund when you file your return.

The IRS evaluates payments by period, not just in total.

How to Make an Estimated Tax Payment (Simple Version)

Making an estimated tax payment does not require special forms or mailing anything.

Here’s the simplest way to do it:

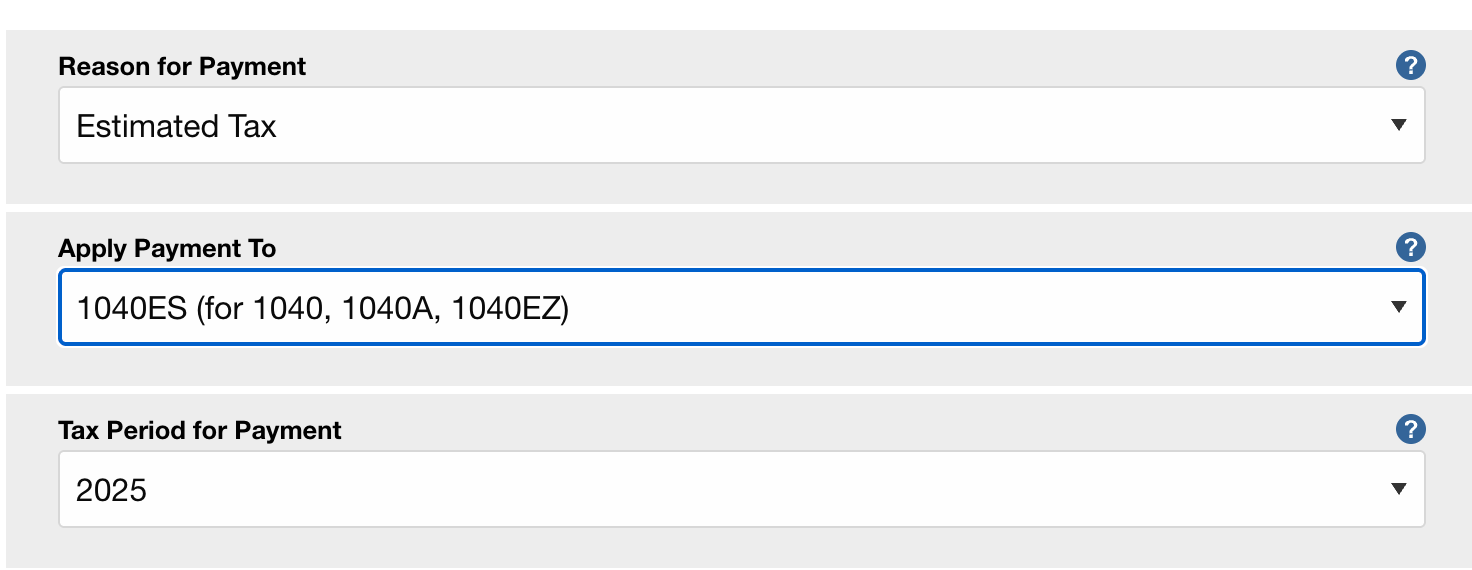

Go to IRS.gov and select “Make a Payment.” (or use your individual IRS account)

Choose payment type: “Estimated Tax.”

The system will automatically apply the payment to the current tax year.

Choose how you want to pay — bank account, debit card, or credit card.

Submit the payment and save your confirmation - make sure to screenshot the receipt of your payment that shows date, amount, last 4 digits of account paid from and the payment type.

Provide these receipts to your tax accountant.

Important:

Estimated tax payments should be made from your personal bank account, not your business account, and they must be paid under your Social Security Number (SSN). Estimated taxes are a personal tax obligation, even when the income comes from a business.

The most asked question is “How do I calculate Estimated Taxes?”

This is the question we hear most often from business owners — and understandably so.

At a high level, calculating estimated taxes requires you to:

Estimate your total sales income for the year/quarter

Subtract business expenses

Add any other incomes received during the year (interest, dividends, rental, etc)

Deduct standard or itemized deduction

Deduct any other allowable adjustments like QBI deduction, ½ of SE tax, student loan interest paid etc

Calculate federal (and state) tax liability based on your taxable income tax bracket

Deduct any allowable tax credits (child tax credit, foreign tax paid credit, educational credit etc)

Don’t about Self-employment tax if reporting income on Schedule C

Divide the total amount to across the remaining IRS quarters

When It Makes Sense to Get Professional Help

You should consider working with a tax professional on estimated tax payments if:

Your income fluctuates or is seasonal

You have business income, real estate, or investments

You’re an S-corp owner taking distributions

You had a large increase in income this year

You want to avoid penalties without overpaying

Estimated taxes are not just about making payments - they’re about planning your tax year correctly.

Need Help With Estimated Tax Payments?

If you’re unsure whether you’re paying the right amount - or want to avoid penalties without overpaying - we can help.