Navigating the 2025 Tax Landscape: Key Updates from the "One Big Beautiful Bill”

The "One Big Beautiful Bill" (H.R. 1) has introduced a slew of tax changes for 2025 that could transform your financial planning. From tax-free tips to enhanced child tax credits, these updates present opportunities to save—but only if you’re proactive. At Tottax, we’re here to break down the most significant provisions and guide you toward maximizing your tax benefits. Let’s explore the key changes and how they impact you!

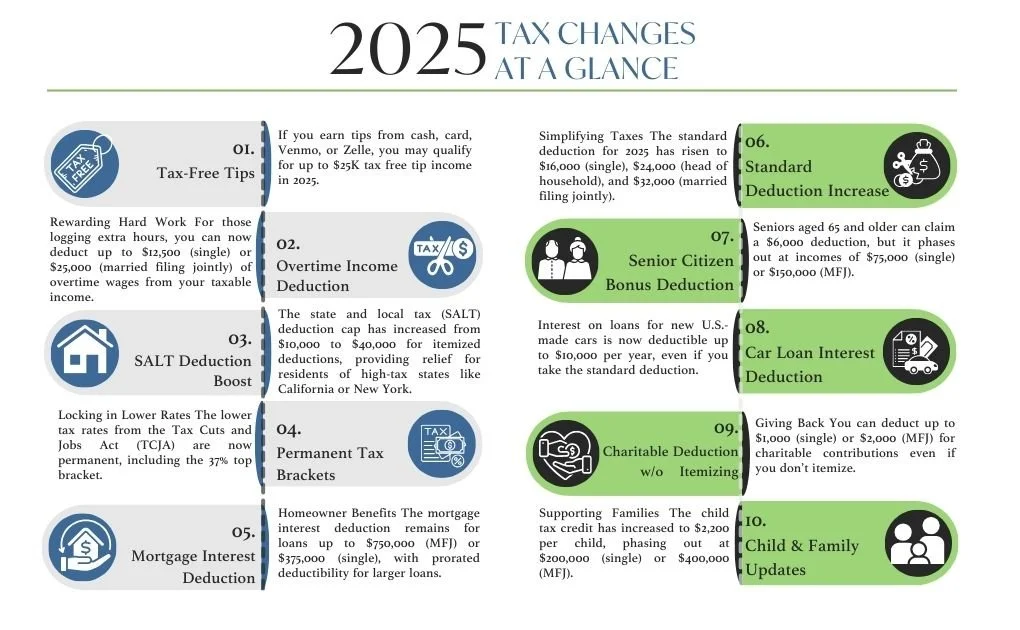

1. Tax Free Tips

A Win for Service Workers (2025–2028) If you earn tips—whether in cash, by credit card, or through digital platforms like Venmo—you could benefit from a major tax break. Tips up to $25,000 per year are now excluded from taxable income, though Social Security and Medicare taxes still apply. This benefit phases out for incomes above $150,000 (single) or $300,000 (married filing jointly).

Pro Tip: Keep detailed records of your tips, and ensure your employer or payment platform does the same. This will streamline tax season and help you claim this exclusion.

2. Overtime Income Deduction:

Rewarding Hard Work For those logging extra hours, you can now deduct up to $12,500 (single) or $25,000 (married filing jointly) of overtime wages from your taxable income. This deduction applies specifically to overtime pay and phases out at incomes above $150,000 (single) or $300,000 (MFJ).

Action Item: Save your final paystub of the year, which should detail your overtime earnings. Share it with your Tottax advisor to ensure you claim this deduction accurately.

3. SALT Deduction Boost:

Relief for High-Tax States (2025–2029) The state and local tax (SALT) deduction cap has increased from $10,000 to $40,000 for itemized deductions, providing relief for residents of high-tax states like California or New York. However, this increase phases out for adjusted gross incomes (AGI) above $500,000 and reverts to $10,000 in 2030.

Planning Note: If you itemize, review your property and state income taxes with your Tottax professional to optimize this deduction.

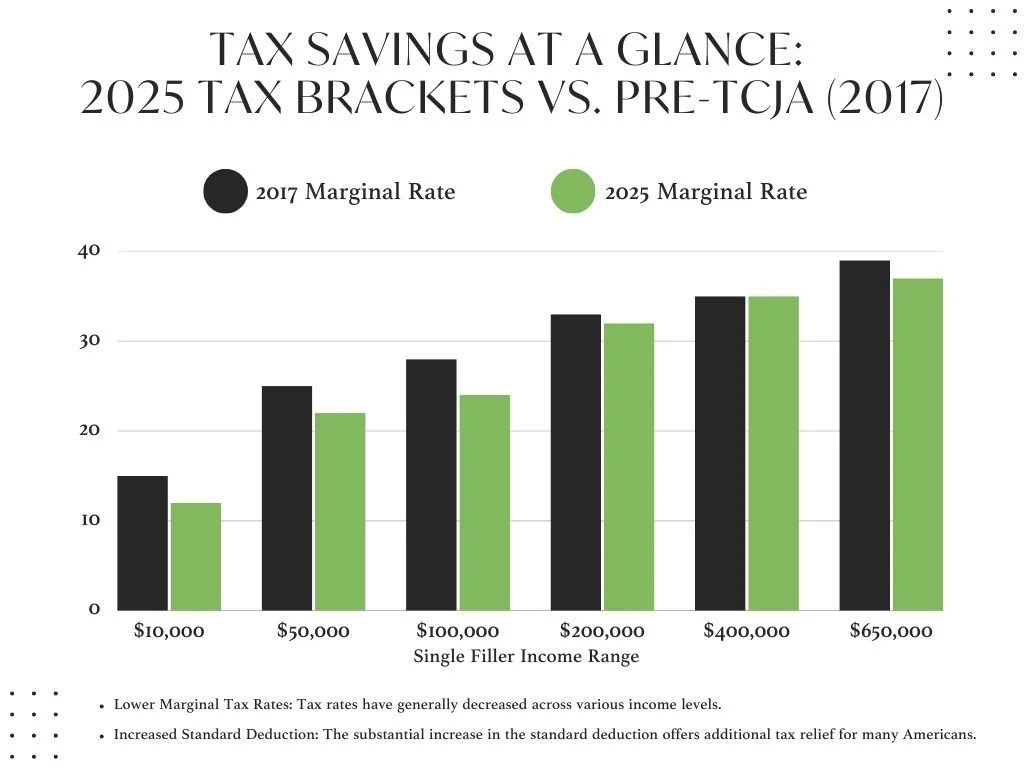

4. Permanent Tax Brackets:

Locking in Lower Rates The lower tax rates from the Tax Cuts and Jobs Act (TCJA) are now permanent, including the 37% top bracket. This stability offers predictability for long-term financial planning, whether you’re saving for retirement or investing.

Why It Matters: Knowing your tax bracket helps you make informed decisions about income, deductions, and investments. Connect with Tottax to map out your strategy.

5. Mortgage Interest Deduction:

Homeowner Benefits The mortgage interest deduction remains for loans up to $750,000 (MFJ) or $375,000 (single), with prorated deductibility for larger loans. Mortgage insurance premiums are deductible again, but interest on home equity lines of credit (HELOCs) is not.

Planning Tip: Gather your mortgage statements and insurance premium records to ensure you claim the full deduction if itemizing.

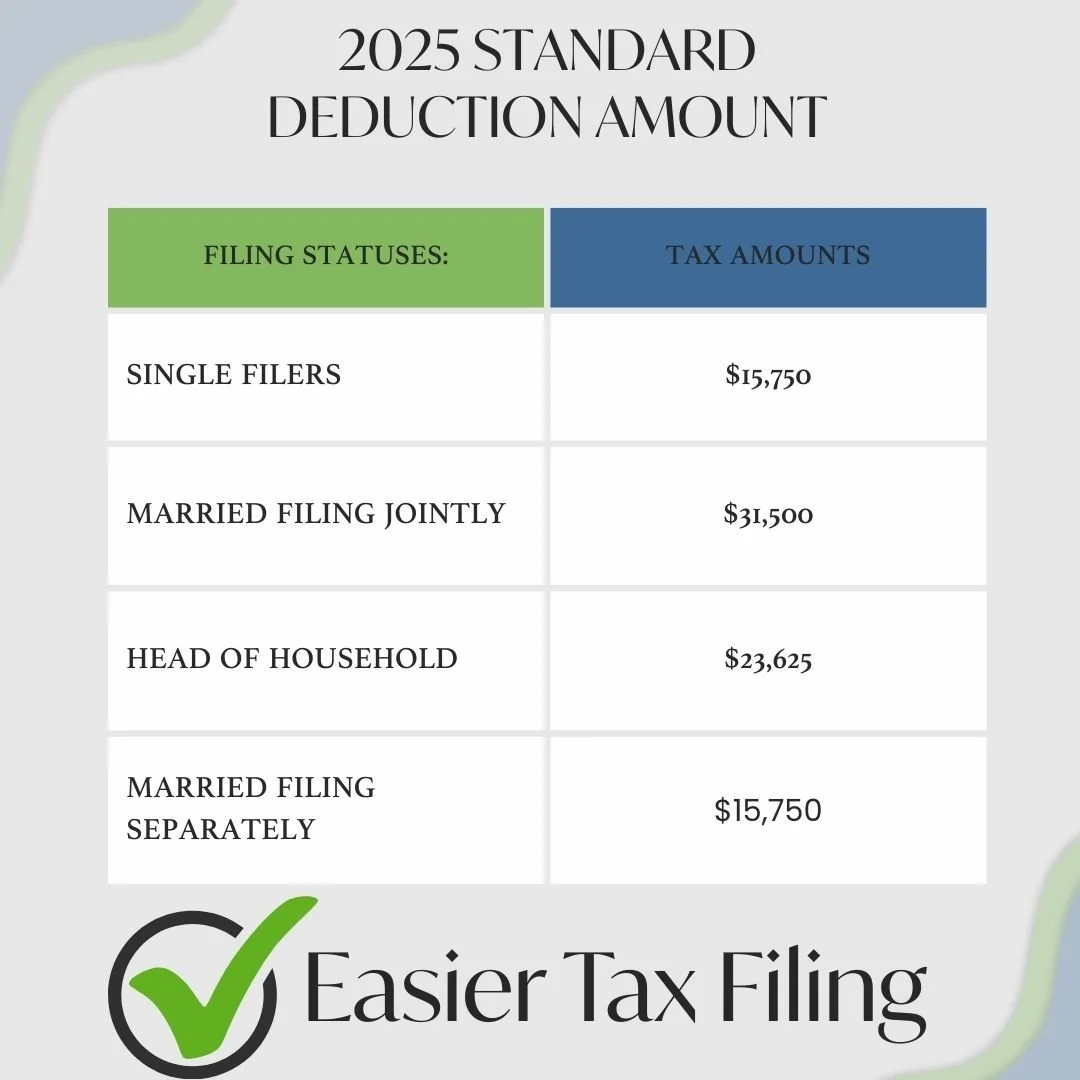

6. Standard Deduction Increase:

Simplifying Taxes The standard deduction for 2025 has risen to $16,000 (single), $24,000 (head of household), and $32,000 (married filing jointly). This increase simplifies tax filing for those who don’t itemize and could lower your taxable income.

Action Item: Compare the standard deduction to your potential itemized deductions with your Tottax advisor to choose the best option.

7. Senior Citizen Bonus Deduction:

Supporting Retirees (2025–2028) Seniors aged 65 and older can claim a $6,000 deduction, but it phases out at incomes of $70,000 (single) or $150,000 (MFJ). This is a great opportunity for retirees to reduce their tax burden.

8. Car Loan Interest Deduction:

Driving Savings (2025–2028) Interest on loans for new U.S.-made cars is now deductible up to $10,000 per year, even if you take the standard deduction. This benefit phases out at incomes of $100,000 (single) or $200,000 (MFJ).

Action Item: Keep records of your car loan interest payments and vehicle purchase details to claim this deduction.

9. Charitable Deduction Without Itemizing:

Giving Back: You can deduct up to $1,000 (single) or $2,000 (MFJ) for charitable contributions even if you don’t itemize. This makes it easier to support causes you care about while saving on taxes.

Pro Tip: Save receipts for your donations and share them with your Tottax advisor.

10. Child & Family Updates:

Supporting Families The child tax credit has increased to $2,200 per child, phasing out at $200,000 (single) or $400,000 (MFJ). Additionally, the new "Trump Account" provides a free $1,000 per child to start a savings account, with contributions up to $5,000 per year until age 18. Withdrawals are tax-free for qualified expenses, which now include an expanded list (e.g., education, childcare).

Must-Do: If you have kids, set up a Trump Account ASAP to take advantage of this tax-free growth opportunity.

11. Other Notable Updates

Gambling Loss Limitations (2026 Onward)

Starting in 2026, gambling loss deductions are capped at 90% of winnings. For example, if you win $10,000 but lose $10,000, you’ll owe taxes on $1,000. Keep detailed records of your gambling activities to report accurately.

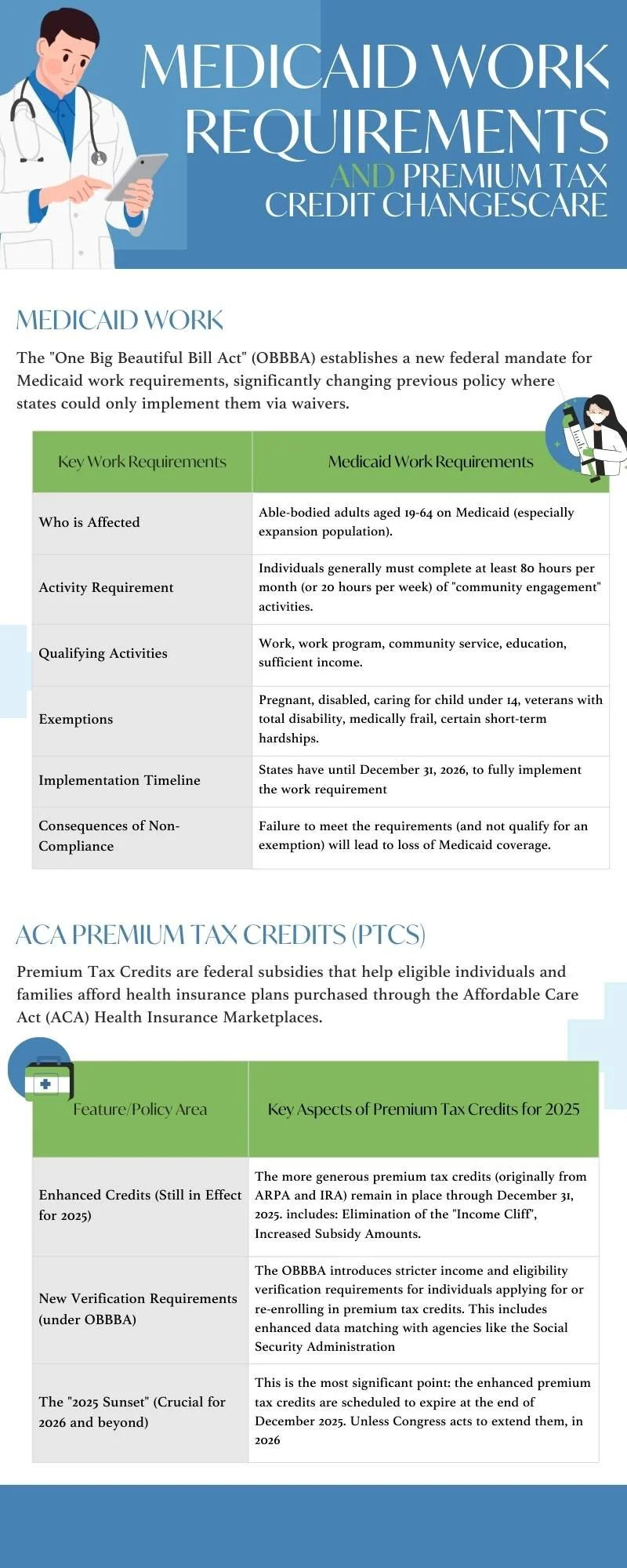

12. Health & Income Provisions

Medicaid now requires 80 hours of work per month. Premium tax credits continue, but starting in 2026, the payback cap is removed, and those who owe excess credits may be barred from future advance credits if not reconciled properly.

13. Clean Vehicle & Energy Credits Phase-Out

The $7,500 new EV credit ends September 30, 2025, the $4,000 used EV credit ends December 31, 2025, and commercial clean vehicle and EV charger/home solar credits phase out by mid-2026. If you’re planning to buy an EV, act fast!

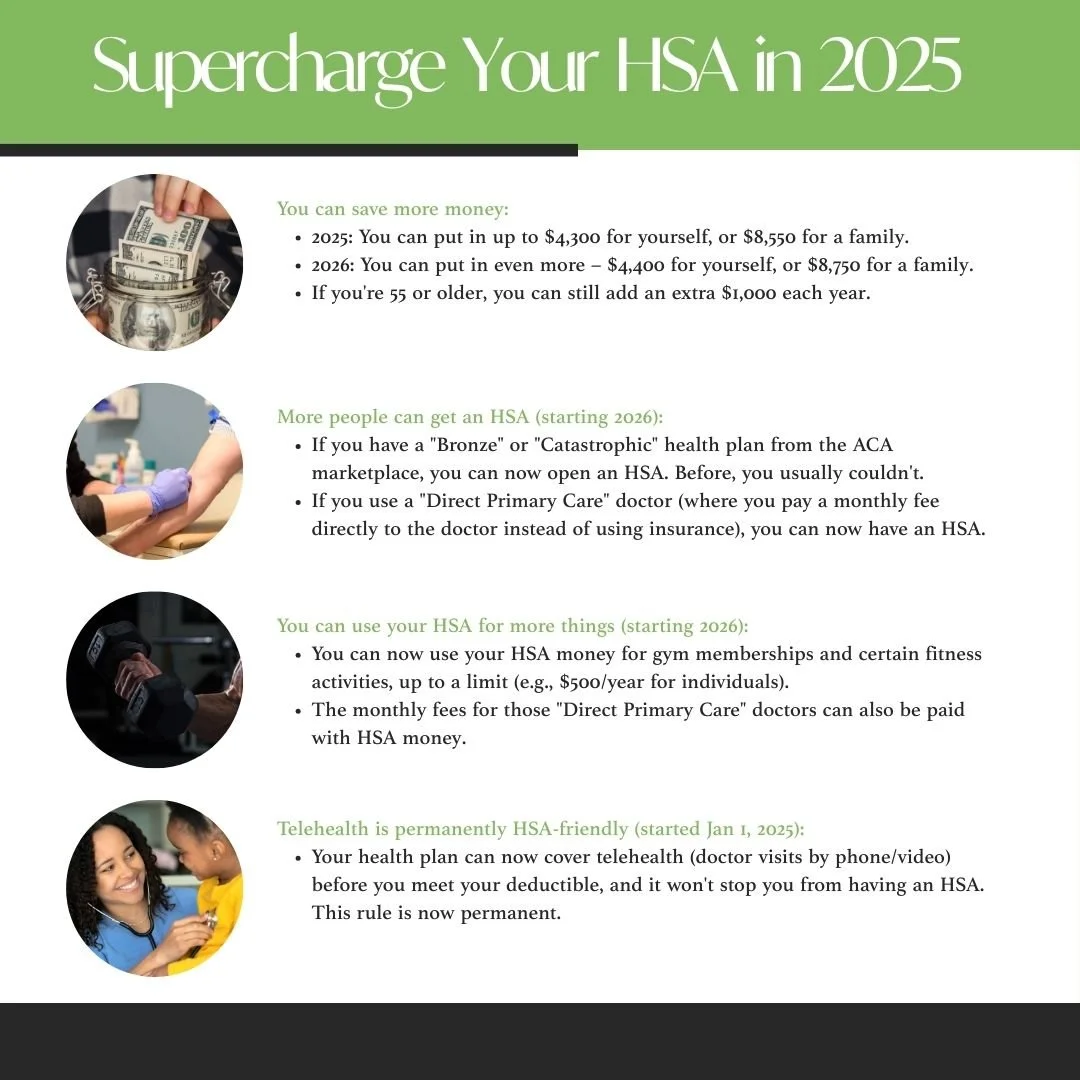

14. HSA Updates: Boosting Health Savings

Health Savings Accounts (HSAs) got a major upgrade in 2025:

Medicare Part A enrollees can contribute to HSAs alongside high-deductible health plans (HDHPs).

Expanded covered expenses include gym memberships ($500 individual/$1,000 family), direct primary care ($150/month), and on-site employer clinics.

Medical expenses incurred up to 60 days before opening an HSA are now reimbursable.

Couples aged 55+ can pool catch-up contributions into one HSA.

Contribution limits increase by $4,300 (individual) or $8,550 (family), with phase-outs at $75,000–$100,000 (single) or $150,000–$200,000 (MFJ).

Unused balances from FSAs/HRAs can roll over to HSAs, and spousal FSAs no longer block HSA eligibility.

Why It Matters: HSAs are a triple tax-advantaged tool—contributions are deductible, growth is tax-free for qualified expenses, and withdrawals are tax-free. Maximize your contributions with Tottax’s guidance.

Your Path to Tax Success with Tottax

The 2025 tax changes offer something for everyone, but they also come with phase-outs, deadlines that require careful planning. Don’t leave money to chance—partner with Tottax to review your income, deductions, and credits to craft a personalized tax strategy. Whether you’re a tipped worker, parent, senior, or EV buyer, we’re here to help you navigate this new landscape.

Schedule a consultation with Tottax advisor today to unlock your 2025 tax savings! Visit Tottax Accounting Agency to book.

Disclaimer: This summary is for informational purposes only and does not constitute tax advice. Consult a qualified tax advisor for personalized recommendations. View the full bill at H.R. 1 – Congress.gov.