Understanding the Cost of Tax Preparation for Small Businesses in Denver

The cost of tax preparation isn’t what shows up on your invoice — it’s what quietly vanishes from your bank account because someone didn’t ask the right questions. A few hundred bucks for someone to plug in numbers? Cute. But John, who runs a café in LoDo, thought the same thing. His $150 “deal” ended up costing him $8,745 in missed deductions, a flagged return for mileage nonsense, and a permanent twitch whenever he hears “IRS.”

Here’s the thing no one tells you: paying less upfront often means handing more over later — to the IRS, to missed funding, to some lender who thinks your books are fiction. If you're running a Denver business and haven’t looked at how tax prep actually affects your bottom line, this is your early warning system.

We’ve helped clients legally shave off up to 27% in tax weight. You might be next.

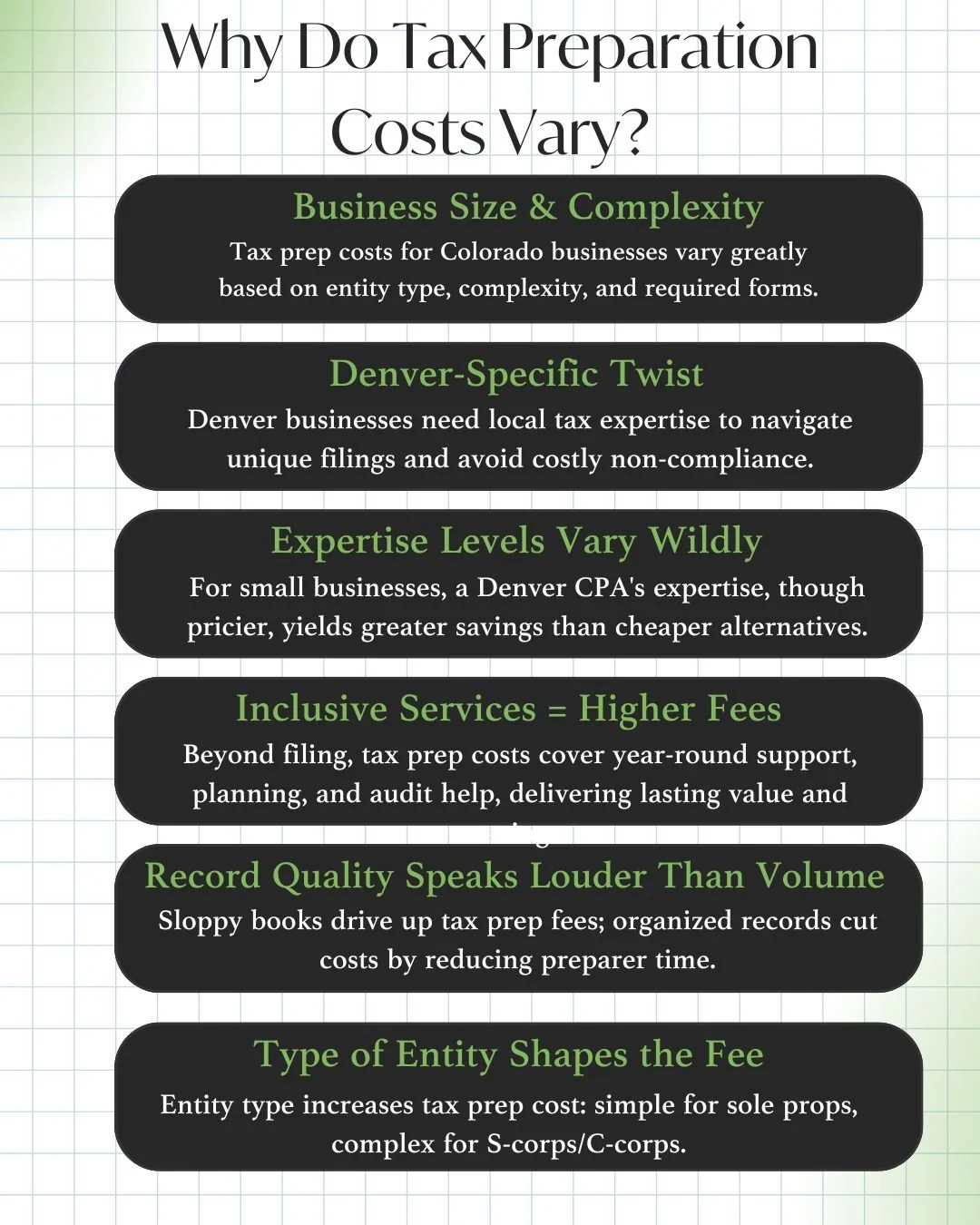

Why Tax Preparation Costs Vary

Denver’s small business scene is a wild mix—from backyard startup founders to precision-focused retailers. That’s why the cost of tax preparation isn’t a flat fee—your business is a unique creature, and your tax prep needs to match. Let’s break down the real reasons one entrepreneur pays $350 while another gets slapped with a $1,200 invoice.

1. Business Size & Complexity

Running a one-person consultancy is worlds apart from juggling payroll, inventory, and gig-economy contractors. A sole proprietor might glide through Form 1040 and Schedule C, but a multi-person LLC or investor-heavy corporation often needs Form 1120, partnership schedules, even cross-border disclosures. That’s more forms, more prep hours, more legal nuance. Here in Colorado, that can mean the difference between mid-range average cost of tax preparation or the stratospheric fees required for complex setups.

2. Denver-Specific Twist

Denver's tax climate has its quirks—General Business Licenses, RTD payroll filings, and BPP (Business Personal Property) returns that Kansas or Idaho businesses never see. If your preparer doesn’t speak “Colorado fluently,” you’re risking non-compliance and back fees—unfortunately, the kind that can blow your bottom line fast. Local expertise here is non-negotiable, not optional.

3. Expertise Levels Vary Wildly

You can choose between a task-list-following non-CPA or a sharp CPA/EA prepped to spot obscure incentive programs. Professional tax services for small businesses come at a premium for that expertise. A Denver CPA’s hourly can range from $300 to $450, compared to $100–$200 for amateur help or tax software. Sure, expertise costs more—until it saves you thousands in missed deductions or red-flags.

4. Inclusive Services = Higher Fees

You’re not just paying to file—you’re paying for guardrails. Proper tax prep should include quarterly check-ins, tax planning strategy, audit support, and year-round bookkeeping oversight. These extras bump up the upfront bill, but they deliver lasting value: smoothing cash flow, reducing surprises, and grilling deductions you didn’t even know existed.

5. Record Quality Speaks Louder Than Volume

Few things drive up tax preparation fees faster than sloppy books. A stack of shoebox receipts or a half-baked spreadsheet means your preparer is also digging, chasing chats, cleaning up—at your expense. Well-organized records can slice hours off prep time and reduce expensive add-ons. That’s why affordable tax services can feel cheaper when proactive, not reactive.

6. Type of Entity Shapes the Fee

Entity type is cost. A sole prop files a Schedule C, but an S-corp, partnership, or C-corp means forms upon forms, from 1120 to K-1s, 2553, 5471. Each extra form demands precision and legal understanding that drive up average cost of tax preparation significantly.

Key Factors Influencing Tax Preparation Costs

Time to rip the lid off the six cost categories that either drain your wallet or build strategic advantage.

A. Business Complexity & Entity Type

Different forms, different headaches. A sole proprietorship with Schedule C vs. a corporation using Form 1120 are different ecosystems. Typical Schedule C prep is about $192, while corporate 1120 prep averages a jaw-dropping $913. Here in Denver, that can double if you're tangled in multi-state filings or Colorado-specific add-ons.

B. Volume of Transactions

One invoice a week? Smooth sailing. A hundred retail transactions daily is a detective’s job. In Denver, where small business taxes run across retail shops, breweries, and bustling consultants, counts matter. High transaction volume stretches prep time, demands granular bookkeeping, and boosts tax preparation fees by at least 5–10%.

C. Quality of Bookkeeping

Clean books save you money. According to the National Association of Tax Professionals, messy setups tack on about $166 for basic sorting and up to $377 for deep data scrubbing. Add poor bookkeeping to your Denver small business, and those fees spiral. Conversely, tight financial records mean fewer hours, fewer surprises—and fresher cash in your pocket.

D. Preparer Credentials (CPA vs. Non‑CPA)

When it comes to professional tax services for small businesses, credentials matter. A non-CPA or software-driven prep may start at $300. A CPA or Enrolled Agent? $500–$2,000+. That’s a big jump, but a CPA brings advanced deduction searches, Colorado-specific mindset, and compliance fluency. If you're paying less, you're asking less—and that could cost you far more.

E. Value Add: Tax Planning & Strategy

Prepping taxes without a tax planning strategy is like buying plane tickets on the day you fly—expensive and rushed. Denver pros offering quarterly strategy sessions, audit insurance, and year-end planning often packet these services at $1,200–$2,500 annually. Yes, that’s more upfront—but smart savings now and streamlined filings later? That’s what business-savvy tax prep should deliver.

F. Location and Local Rules

Colorado taxes and Denver business licensure demand local know-how. Your preparer should be fluent in local filings—RTD parcels, BPP flags, ordinances you didn’t know exist. Hiring someone unfamiliar is a one-way ticket to late notices and penalty fees. In Denver, cost of tax preparation is higher not because vendors mark it up—they’re doing what out-of-towners won’t.

Why This All Matters

You see the math: the easier you make your preparer’s job, the more money stays in your business. Disorganized records. Cheap non-CPAs. Missed local filings. These are not minor misfires—they erode profits, inflate tax preparation fees, and put your future on shaky ground.

But it doesn’t have to be this way. Partnering early with a skilled firm offering affordable tax services that include clean bookkeeping, custom planning, and Colorado expertise means a leaner, smarter tax season. One that saves, not bleeds.

Comparing Tax Preparation Options

You’ve got three big routes when it comes to small business taxes in Denver:

DIY tax preparation software,

Professional tax services for small businesses (e.g., CPAs, Enrolled Agents, firms), or

In-house bookkeeping versus outsourced services.

While each option has its benefits, the approach that's right for you depends on your business's needs. For a new company, understanding the right combination of accounting and bookkeeping services for startups is key to making a smart financial decision.

A. Tax Preparation Software

Yes, software like TurboTax, H&R Block, or TaxAct lets you DIY for $50–$200 (Taxfyle claims up to $179). Ideal for solo proprietors with clean books, it’s cheap and easy. But once your operation gets busier, the software trips on complexity. Say you’re filing multi-state taxes or tracking RTD payroll in Denver—you risk major flubs. One study found 1 in 5 DIY users end up with costly errors or missed deductions from simple arrogance—and sometimes regret.

For stripped-down businesses, software works. For anything more? It’ll bite you back—with inaccurate filings that waste refunds or invite IRS audits.

B. Professional Tax Services (CPAs or Firms)

Then there’s the pro league: expert CPAs and Enrolled Agents who charge $500–$2,000+ in Denver—depending on complexity (Milestone, 1800Accountant). It hurts—but here’s the defense:

They know Colorado like locals—they handle Denver’s Business Personal Property forms and RTD payroll like breathing.

They spot deduction gold others miss—like local incentive credits or optimal depreciation schedules.

They’re your fallback in an audit, not some “press 0 for help” software trap.

The AICPA says CPAs uncover refunds or savings 2–3x more often than software users. That’s real cash.

So yes, it’s pricier than software, but it’s smarter money. And you sleep better.

C. In-House Bookkeeping vs. Outsourced

What seals or sinks your cost of tax preparation is your bookkeeping. Spot-on, organized books slash prep time. But most Denver startups don’t have a full-time bookkeeper. That’s where tailored bookkeeping support from a trusted local firm comes in.

Hiring a pro handles your entries, reconciliations, and advance deductions for $300–$600/month, which—newsflash—can slice tax prep fees by 30–40% per year. It also means less year-end chaos. This is small business accounting done proactively, not defensively.

Keep messy books and brace yourself for cleanup fees. That’s also why professional tax services for small businesses push bookkeeping to the front of their packages—it saves time and cuts tax preparation fees in a clean swipe.

Maximizing Value from Tax Preparation Services

If you’re paying for prep, you might as well wring every cent of value from it. Follow these six high-yield tactics to keep fees down and punch up your return.

1. Stay Organized Year-Round

Stop freaking out in April. Take 15 minutes a week—not just at year-end—to categorize expenses, file receipts, and update income. According to the National Association of Tax Professionals, messy records cost an added $166–$377 in cleanup alone. That’s money you just threw. Keep your books tidy, and your tax preparation software or CPA can work faster—and cheaper.

2. Maximize Business Tax Deductions

Most Denver businesses leave $2,000–$7,000 on the table by forgetting deductions, from home office write-offs to RTD commuter benefits. A solid CPA uncovers these—and more obscure perks like Colorado’s enterprise zone credits. That’s why investing in professional tax services for small businesses is a strategy. You pay to legally pay less.

3. Lock in Quarterly Tax Planning

Stop treating tax prep like a surprise exam. Book quarterly check-ins to forecast liability, optimize deductions, and adjust payment withholdings. Firms offering this tax planning strategy see clients improving net income by 15–20% compared to annual-only prep. This approach also smooths cash flow and steals no-penalty payment timing.

4. Choose a Local CPA Who Knows Denver

Denver’s tax quirks are real. Prepping with someone who doesn’t know RTD or BPP is like sending a cat to do algebra. Local compliance is non-negotiable. When you hire a Denver-based CPA fluent in city and state regulations, you're paying for accuracy—and peace of mind.

Conclusion

Tax preparation software is cheap but limited; professional tax services for small businesses cost more but deliver better returns; and tailored bookkeeping support underpins everything. Together, these strategies turn tax prep from a season of dread into a profit-retention machine.

Depending on your business setup, you could pay anywhere from $50 to over $2,500 annually. But here’s the real cost equation: invest in accuracy and strategy now—or risk headaches, missed money, or IRS callbacks later.

Ready to Simplify Your Small Business Taxes in Denver?

Stop gambling on DIY software or bookkeeping shortcuts. At TotTax, we combine small business accounting, smart bookkeeping, Colorado savvy, and tax planning strategy into affordable tax services that respect your time and money. We’re not just here to file—we’re here to amplify your cash flow.

👉 Contact us now for a free, no-obligation session. Get transparent pricing, personalized strategy, and a prep process built for Denver entrepreneurs like you.

Frequently Asked Questions

-

Yes. The IRS allows businesses to deduct the full cost of tax preparation related to business filings, including bookkeeping and planning services. Personal return prep isn't deductible, but anything tied to your business is fair game—and smart business owners write it off every year.

-

Between $500–$2,000+, depending on your entity type, record quality, number of transactions, and whether you need additional services like tax planning or audit support. Denver-specific requirements—like RTD payroll and BPP filings—can raise the bar, making professional tax services for small businesses a smarter, long-term play.

-

You can—but be cautious. Tools like TurboTax or H&R Block work for simple returns (usually sole props with no employees). But if you're managing inventory, dealing with local taxes, or filing multi-state, tax preparation software may miss key deductions or trigger avoidable errors. Professional help becomes worth its weight when real money’s on the line.

READ MORE…

The Essential Benefits of Outsourced Accounting Services in Denver